Living Happy Fiscally Ever After

By Patricia Seaman

Wedding season is upon us and couples everywhere are joining hearts and souls in marital bliss. But how do couples join checkbooks and live happily fiscally ever after? What should you know about your partner’s finances before saying “I do”? How can you work together to equally divide living expenses? And how do you avoid the potential pitfall of financial infidelity?

Q: What should you and your partner know about combining finances when getting married?

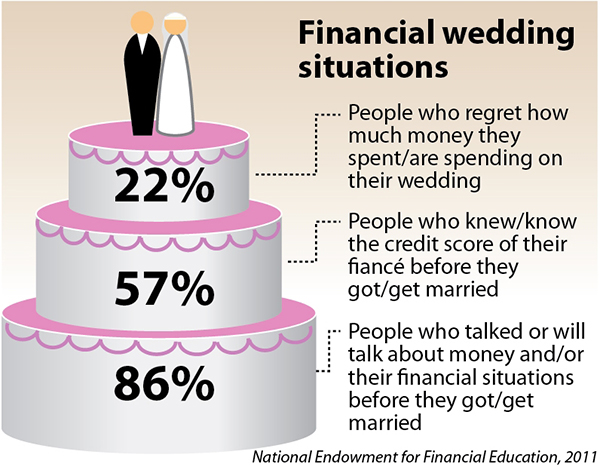

A: A survey conducted by NEFE found 86 percent of new couples indicated that they are indeed discussing money and joining finances before their wedding. But are they having the right conversations? And are they keeping the dialog going after the wedding day?

There are certain topics that need to be in the conversations new couples have. First, decide how to divide household expenses – it should be proportionate to each partner’s salary. Each partner should have at least some small amount of discretionary spending. Review each other’s credit scores prior to the marriage. Your credit scores will dictate how and if you apply for joint loans (mortgage, credit card, etc.)

Remember, if you add your spouse onto a credit card or loan, you now become responsible for that debt.

Q: What can couples do if they have conflicting personalities when it comes to money?

A: Do not assume you know where your partner is coming from when it comes to money.

A great tool that NEFE encourages all couples to take advantage of is our Life Values Quiz (http://www.smartaboutmoney.org/Tools-Resources/LifeValues-Quiz.aspx). It will help you identify your partner’s attitudes about money and will offer tips on how to co-exist successfully financially with partners who have either the same or differing attitudes about money. The quiz is easy to take and is only 20 questions.

Q: What are some of the red flags that signal financial infidelity?

A: While our survey indicates that most new couples are talking about money, we found through a survey that one in three in relationships have committed financial infidelity - which could be anything from hiding cash and hiding purchases to hiding entire accounts or lying about income or debt.

There are a few indicative signs that your partner may be cheating financially. This includes coming across a receipt or a piece of paper indicating a purchase that you don’t recognize. Your spouse may not allow you to see copies of every bill each month or your partner has removed the itemization of purchases for the month portion of the bill. And if he or she has something to hide, your partner may likely act defensive or withdrawn on the topic of money.

In order to rebuild trust with your partner after financial infidelity occurs, understand that it takes time, sustained transparency and a commitment from both to stick to the goals that you’ve set together.

Q: What are some financial tips for getting married the second time around?

A: Look closely at where your partner is coming from financially and take into account expenses that are inherited into the marriage. If your spouse has children from his/her first marriage, take connected monthly costs into consideration. Also, look at debts from the first marriage and seek to learn what your partner’s financial commitments are in regards to the former spouse.